How will this influence the price of cars?

We’ve taken a more holistic view by looking at the macroeconomic environment as a whole. Although rates have gone up, asset values are decreasing. In other words, assets (cars) aren’t costing as much as they used to, which has the potential to be incredibly favourable.

Here's an example:

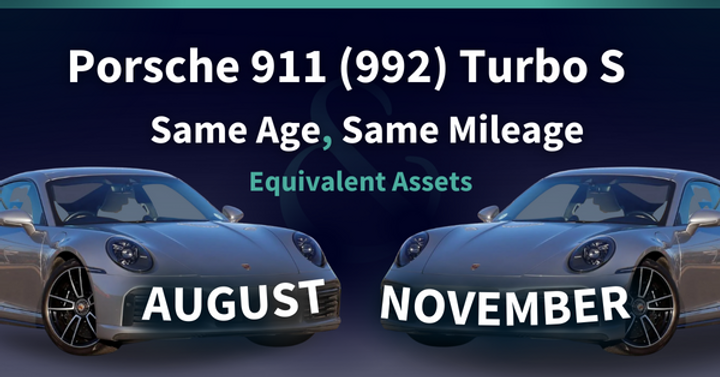

We’ve broken down the figures for the fantastic Porsche 911 (992) Turbo S.

These two cars are ‘equivalent assets’; same age, same mileage. One was being sold in August and one in November of this year. If you financed this car through the bespoke package below, your net position would have improved by around £7,645.04, based on the same purchase in August.

In total, the amount payable has reduced from £237,159.28 in August to £224,804.32 in November, meaning you could have saved £12,354.96.

Asset Value is decreasing faster than Asset Cost, a differentiation that you could certainly benefit from.

Written by

Dean Clarke

With over 15 years in the motor industry, Dean is an experienced Motor Finance Broker and leads the Charles & Dean Motor division. Dean has love for all things automotive, with a real passion for unusual and quirky cars. Over the years, he’s built strong relationships with a wide network of lenders and suppliers, ensuring clients have access to the best finance solutions.

Table of contents

Apply for Finance

Let’s start with your name & email

Please provide your details to receive a personalised quote.

Subscribe

Get the latest insights and updates delivered to your inbox weekly.

.png?width=806&height=605&name=Why%20Use%20a%20Car%20Finance%20Broker%20(4).png)