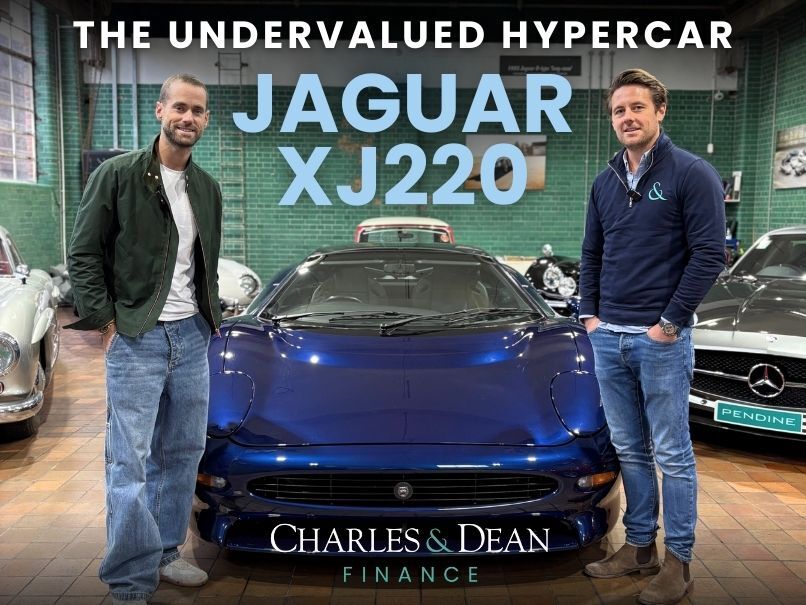

"I’m into my fifth year now with Charles & Dean, with the latest addition being my Ferrari 250 GT. The whole process was dealt with efficiently and with surprisingly palatable numbers.

C&D work with a number of lenders and offer an incredible personal service you won't find anywhere else."

Tom Exton

Ferrari 250 GT

.png?width=806&height=605&name=Why%20Use%20a%20Car%20Finance%20Broker%20(4).png)